- Get link

- Other Apps

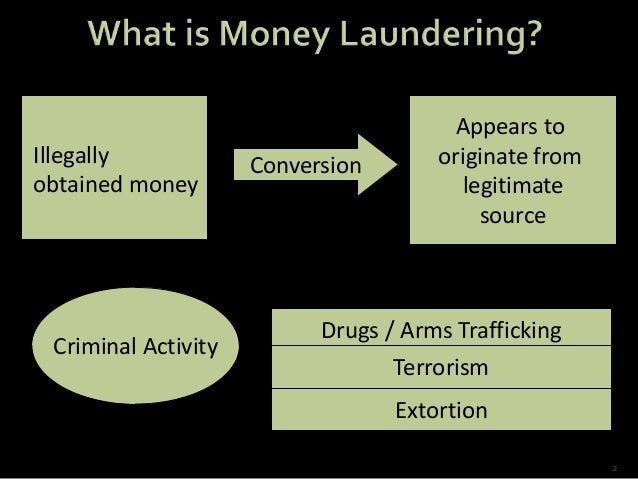

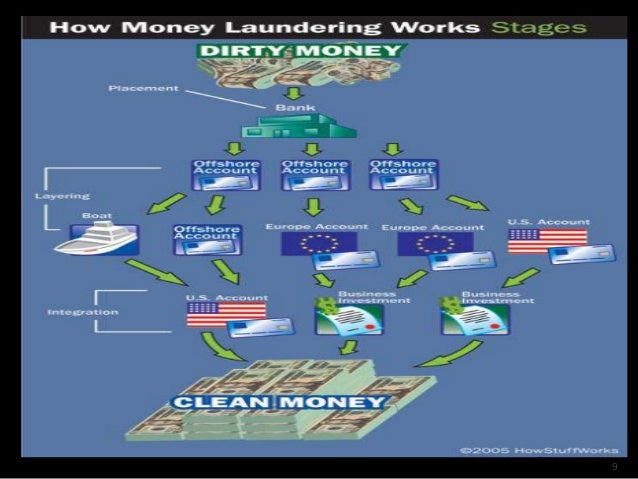

The idea of cash laundering is very important to be understood for those working in the monetary sector. It is a course of by which soiled money is transformed into clear cash. The sources of the money in actual are legal and the money is invested in a method that makes it appear to be clear cash and hide the identity of the legal part of the money earned.

Whereas executing the financial transactions and establishing relationship with the brand new customers or maintaining present prospects the duty of adopting adequate measures lie on each one who is a part of the organization. The identification of such component in the beginning is simple to take care of instead realizing and encountering such conditions afterward within the transaction stage. The central bank in any country offers full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present enough safety to the banks to deter such situations.

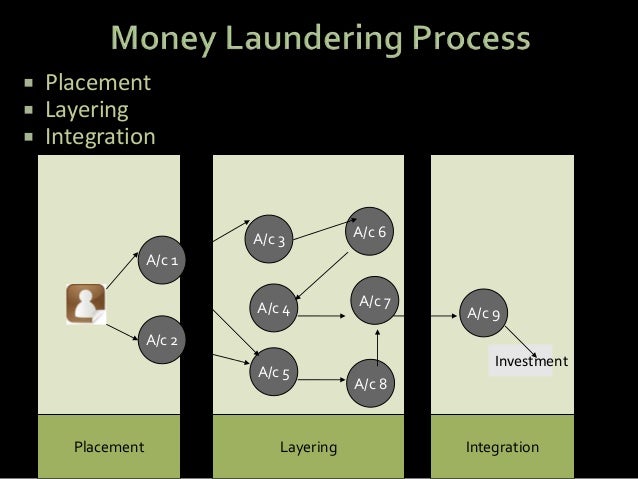

The money laundering cycle can be broken down into three distinct stages. Hence proceeds from the.

Typical Process Of Monitoring Investigating And Reporting Suspicious Download Scientific Diagram

The term walking account was coined because the money in these accounts appears to walk away.

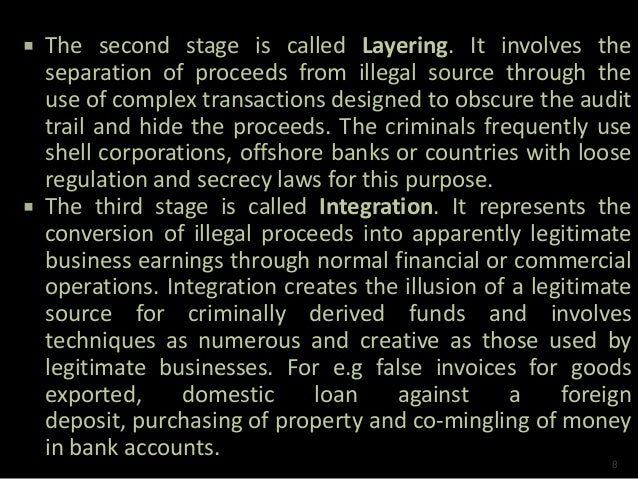

Layering techniques used in the second stage of money laundering process. Layering is second stage in money laundering cycle. For instance many criminal groups use shell companies to buy property. According to Shijia Gao et al 2009 layering is the process of generating a series or layer of transactions to distance the proceeds from their illegal source and obscure the audit trail.

The second stage of money laundering is layering. However it is important to remember that money laundering is a single process. Money launderers use this layering technique because it is extremely difficult to detect and money moves very fast through accounts across the world.

ExamplesStages of Money Laundering Methods Expert Analysis The Annual Report of the Swiss Financial Intelligence Unit 2017 came out. The next stage of money laundering layering allows criminals to remove that traceability and lend legitimacy to their funds. The known methods used are.

Layering is the second stage of the money laundering process in which illegal funds or assets are moved dispersed and disguised to conceal their origin. Layering The second stage of money laundering layering involves the conversion of criminally-derived proceeds into another asset or form of funds and the creation of complex financial transaction layers to cover up the audit trail the source of funds and the ownership of funds. Property Dealing The sale of property to integrate laundered money back into the economy is a common practice amongst criminals.

Once the funds have been placed into the financial system the criminals make it difficult for authorities to detect laundering activity. Layering The second stage is called layering. The Layering Process Layering is often considered the most complex component of the money laundering process because it deliberately incorporates multiple financial instruments and transactions to confuse AML controls.

The launderer engages in a series of conversions or movements of the funds to distance them from their sourceThe funds might be channeled through the purchase and sale of investment instruments such as bonds stocks and travelers cheques or the launderer might simply wire the. The second stage is layering sometimes its also referred to as. The stages of money laundering include the.

5300 Million Swiss Francs have been frozen as a consequence of such reports. It shows that 2909 money laundering cases have been reported to the Swiss Money Laundering Reporting Office. Layering occurs when a money laundering operation goes international and assets are repeatedly transferred withdrawn or deposited.

Stage 2 of Money Laundering. This is the most vulnerable stage of money laundering as criminals are holding on to a bulk of funds and placing it into the financial system which may attract the attention of law enforcement agencies. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

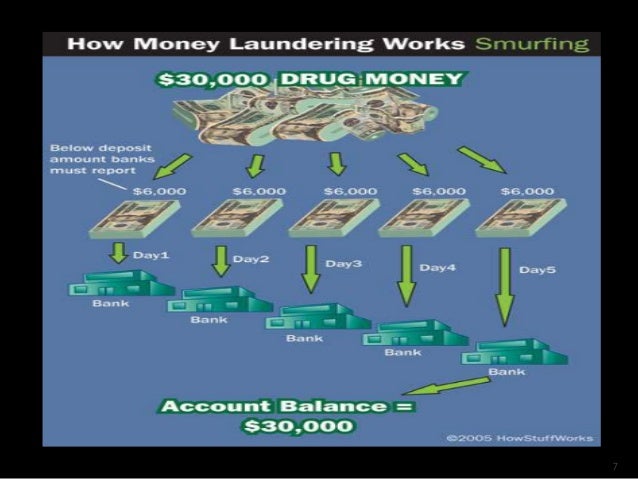

There are many ways of money laundering which are explained in the articles linked at the end of this post. This is a complex web of transactions to move money into the financial system usually via offshore techniques. Layering It is a second stage in money laundering process.

The second stage in the money laundering process is referred to as layering. The purpose of layering is to cut down the bulk in funds and make them into smaller transactions that. Funds can be hidden in the financial.

The Second stage in Money Laundering Techniques is layering. Due to these reasons walking accounts create substantial investigation hurdles for regulators. This is dissimilar to layering for in the integration process detection and identification of laundered funds is provided through informants.

The primary purpose of layering is to separate the illegal proceeds from their origin and to make it difficult to detect and uncover laundering activity. The second step of the typical money laundering event involves layering.

Money Laundering Regulatory Risk Evaluation Using Bitmap Index Based Decision Tree Sciencedirect

First Stage Of Money Laundering Placement People Launder Money Using Money Laundering Techniques For Two Principal Reasons

Definition Stages And Methods Of Money Laundering Indiaforensic

Definition Stages And Methods Of Money Laundering Indiaforensic

First Stage Of Money Laundering Placement People Launder Money Using Money Laundering Techniques For Two Principal Reasons

Stages Of Money Laundering Onestopbrokers Forex Law Accounting Market News

Financial Action Task Force On Money Laundering Fatf Fincen Gov

Stages Of Money Laundering Onestopbrokers Forex Law Accounting Market News

First Stage Of Money Laundering Placement People Launder Money Using Money Laundering Techniques For Two Principal Reasons

The world of regulations can seem like a bowl of alphabet soup at instances. US money laundering regulations are not any exception. We've got compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Risk is consulting agency centered on defending monetary companies by lowering risk, fraud and losses. We've huge financial institution experience in operational and regulatory risk. We've a strong background in program management, regulatory and operational danger in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many opposed consequences to the group because of the dangers it presents. It increases the likelihood of major risks and the opportunity value of the bank and ultimately causes the financial institution to face losses.

Comments

Post a Comment