- Get link

- Other Apps

The concept of money laundering is very important to be understood for those working within the monetary sector. It is a course of by which soiled money is transformed into clean cash. The sources of the money in precise are prison and the cash is invested in a means that makes it seem like clean money and hide the id of the prison part of the money earned.

While executing the monetary transactions and establishing relationship with the brand new customers or maintaining present customers the duty of adopting ample measures lie on every one who is part of the group. The identification of such aspect at first is easy to deal with instead realizing and encountering such conditions later on within the transaction stage. The central financial institution in any nation gives full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide enough security to the banks to deter such conditions.

However there is no need to determine whether the transactions are in fact linked to money. 6-digit Agent with leading zeroes if applicable.

Complete Your Anti Money Laundering Training Here 2019 2020

Take the course successfuly a Company AML training course certificate will appear on your screen.

Aml certification for insurance agents. Kaplan AML Course Review - Anti-Money Laundering Training for Insurance Professionals. Insurance Agent and Broker AML Training Course - 12 AML Training for Insurance Agents and Brokers - 2021 Anti-money laundering compliance training for insurance agents and brokers. This is proof of your Anti-Money Laundering Training.

Certificate awarded upon completion. Anti-Money Laundering for Insurance Agents Title 4 credits 37073. This Act requires insurance companies to establish anti-money laundering programs that comply with the minimum standards set by the Department of the Treasury.

This is because some insurance carriers require one AML training source while other carriers require a different one. Insurance regulations only apply to insurance companies excluding agents and brokers from the requirements. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply.

Last 6 digits of Associate. Last 6 digits of Employee Number. Save a copy of the certificate.

4-digit Telephone Extension. Upon completion of this course you will be able to viewprint your course certificate and you will receive four 4 Utah insurance continuing education CE credit hours. When completing your Symmetry contracting paperwork you should have completed the American-Amicable AML certification.

FinCEN has set a 5000 threshold for transactions that should. A customer designates an apparently unrelated third party as the policys or products beneficiary. Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of.

If the agent has completed the Anti-Money Laundering Training through a broker dealer carrier sponsored program organization sponsored program or any other programcourse other than online with LIMRA heshe will need to provide a completion certificate. WebCE delivers up-to-date anti-money laundering AML training courses to a variety of insurance and financial professionals. A covered product includes.

Accordingly the Authority has decided to put in place the following regulatory guidelinesinstructions to the Insurers Agents and Corporate agents as part of an Anti Money Laundering Programme AML for the insurance sector. You can find the AMLCTF Act at the Federal Register of Legislation website. In a friendly accessible style this course teaches employees and agents how money laundering works and the basics of AMLCTF compliance.

Insurance and financial professionals use AML training courses to familiarize themselves with the process of money laundering the criminal business used to disguise the true origin and ownership of illegal cash and the laws that make it a crime. FinCEN issues a SAR form specifically for insurance companies. This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers.

A customer terminates an insurance product early including during the free-look period. Last 6 digits of SSO Number. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program.

When completing the form insurers must obtain client information from a range of sources including insurance agents and brokers. Anti-Money Laundering Training Program is a fast easy and inexpensive way for financial services companies to meet key requirements of US. Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements.

AML Anti-Money Laundering Training Instructions There are two AML training required. Access the AMLCTF Act. AMLCTF Act current version Your obligations under the AMLCTF Act.

Most insurers will accept this except National Life GroupInsurance Companies Must Establish Anti-Money Laundering. Also forms part of the Insurance Core Principles of the International Association of Insurance Supervisors IAIS. The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act is the main piece of Australian government legislation that regulates AUSTRACs functions.

Among all the things an insurance agent does reporting such suspicious activities is a the top of the list. The built-in exam ensures a baseline level of knowledge throughout your organization while the reporting features allow your compliance team to track student progress and verify course completion.

Ben Feldman Perfected A Series Of Techniques For Selling Life Insurance That Earned Him A Place In The Guin Life Insurance Agent Insurance Salesman How To Plan

Complete Your Anti Money Laundering Training Here 2019 2020

Real Estate Agent Resume Description Elegant 5 Insurance Agent Job Description Sales Resume Examples Sales Resume Job Resume Samples

Multi Line Insurance Agent Business Card Zazzle Com In 2021 Medical Business Card Insurance Agent Medical Business

Different Coverages For Auto Insurance Di 2021

Naaip Free Anti Money Laundering Course Aml Course Free

This Is The Application To Be An Insurance Agent You Need To Fill Out All Information Listed When I Become Things To Sell Insurance Agent Consumer Protection

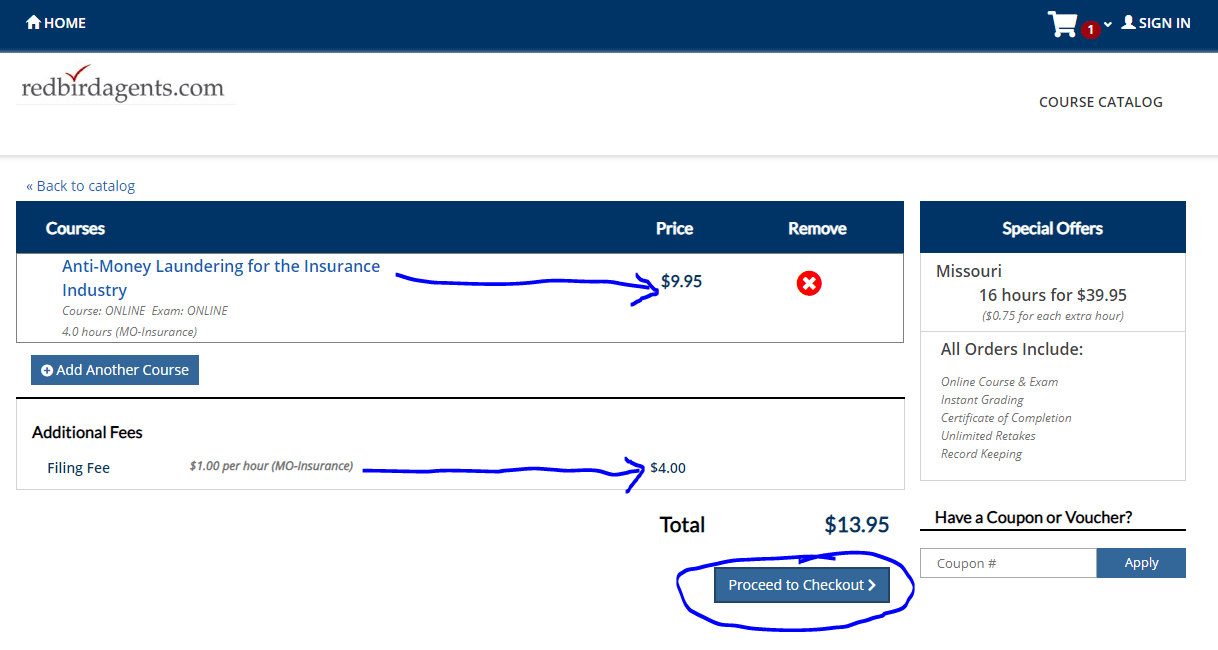

How To Complete Your Free Aml Training For Life And Annuity Sales

Health Insurance Agents Recruitment Health Insurance Agent Insurance Agent Insurance

Neo Banks Vs Neo Insurers Digital Banking Insurance Business Insurance

Complete Your Anti Money Laundering Training Here 2019 2020

Naaip Free Anti Money Laundering Course Aml Course Free

Free Anti Money Laundering For Insurance Agents Aml Course Youtube

Complete Your Anti Money Laundering Training Here 2019 2020

The world of laws can appear to be a bowl of alphabet soup at occasions. US money laundering rules aren't any exception. We now have compiled a listing of the top ten cash laundering acronyms and their definitions. TMP Threat is consulting agency centered on defending financial services by reducing risk, fraud and losses. We have now huge financial institution expertise in operational and regulatory threat. Now we have a strong background in program administration, regulatory and operational danger in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many adversarial consequences to the group as a result of dangers it presents. It increases the chance of main risks and the chance value of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment